A Deeper Look into Sovryn

Bitcoin DeFi is Already Here

One of the more common things I hear about Bitcoin is that it is built upon archaic technology. However, one of the beautiful things about bitcoin is that it is simple enough for other complex applications to be built upon it. Sure you cannot lend, borrow, yield farm, or trade margins with bitcoin on-chain, but that is by design. The base layer of bitcoin is meant for security, giving freedom to other layers to be built for more elaborate use cases like we see in the world of DeFi.

I was very pleased to have stumbled across Sovryn, an ecosystem built on a bitcoin sidechain called Rootstock (RSK) that has implemented much of the DeFi applications we know (and may love) from Ethereum. You may lend your bitcoin to earn interest, you can borrow bitcoin, and you can yield farm with bitcoin.

Even though Sovryn is still in its Alpha phase (at the time of writing) it is giving rise to what I perceive to be a fruitful bitcoin-based DeFi ecosystem. This letter takes a deeper look into my experiments with Sovyrn and what you can expect should you wish to try it out.

How to Use Sovryn

First, navigate to live.sovryn.app.

Sovryn is based on the same technology that Ethereum is built on. Therefore, you can use Metamask to manage every interaction with Sovryn. If you don’t already have and are familiar with MetaMask, I’ll be providing a detailed guide this week on my private newsletter.

Engage MetaMask to Begin

In order to begin playing around with Sovryn, you need to have some bitcoin in your wallet. Click “Engage Wallet” in the top right-hand corner to enable MetaMask.

Select Browser — then MetaMask

Fund Sovryn with Bitcoin

Before we begin, it is necessary that you understand the units of bitcoin that you are using on Sovryn are not (strictly speaking) BTC. The bitcoin on Rootstalk is named rBTC. All fees on Rootstalk (and thus Sovryn) are paid in rBTC, just like all fees on Ethereum are paid in ETH. When you see my screenshots below, you will see rBTC instead of just BTC.

In order to use any feature of Sovryn, you will need to load your wallet with rBTC. Navigate to Portfolio then click on FastBTC. You will be provided with a QR code that BTC can be sent to. Any bitcoin sent to this address will be automatically converted into rBTC.

The whole process of converting BTC into rBTC can take about 20-60 minutes. Once finished, you are ready to use the features of Sovryn.

Converting rBTC back into BTC

One of the questions I’ve seen most in the Sovryn Discord and Telegram is whether or not rBTC can be converted back into BTC. It can, but there are a couple of steps. The fastest way to convert rBTC into BTC (right now) is by sending your rBTC to your KuCoin account. They have a market pair for rBTC/BTC which allows you to easily convert one into the other. The other way is by using Atomic Swap functionality within the Liquality Wallet.

The Many Features of Sovryn

During the last 2 months, I’ve used almost every feature of Sovryn. I’ll be talking about each one of the features along with a project called BabelFish that is building on Sovryn.

Lending Bitcoin

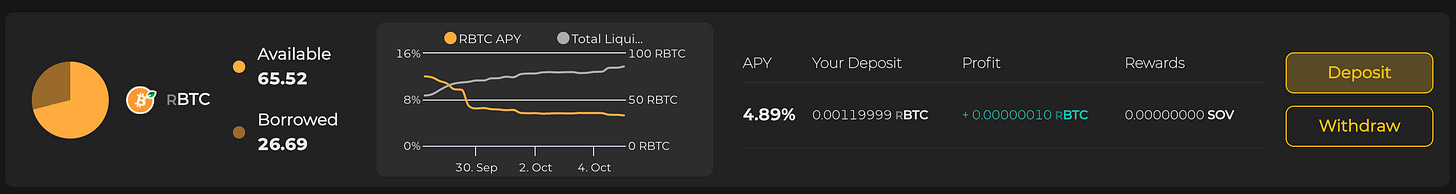

Let’s start with something easy, lending. Sovryn provides a simple interface through which a variety of tokens may be loaned out to other users. In return, the lender receives a return on their investment in the form of interest. It works the same way lending on other DeFi protocols works.

There is a projected APY of 4.89%, but this fluctuates and cannot be relied upon to be static. It depends on whether or not there are borrowers for the bitcoin. I can see my profit increase in real-time which is a great way to pass the time. I’ve only loaned out about $50 USD worth of bitcoin, so in the last 24 hours, I’ve profited 10 satoshis!

Other coins like XUSD (Sovyrn’s USD stablecoin provided by BabelFish) can be loaned as well. No doubt there will be more coins to be loaned in the future.

Yield Farming with Bitcoin

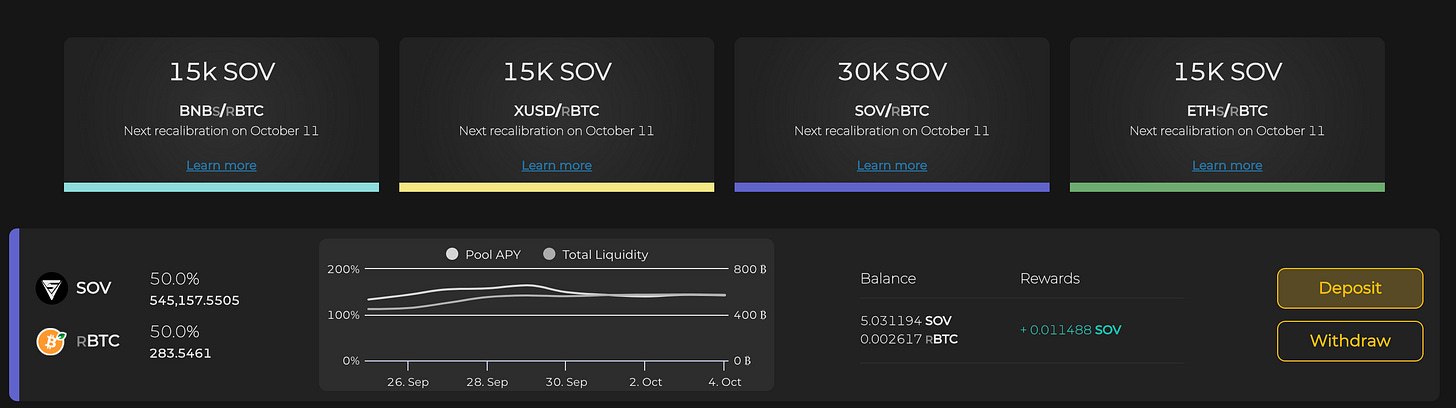

Yield farming is the practice of supplying coins (liquidity) to a decentralized exchange (DEX) in return for a cut of the fees that the DEX charges to traders. Any “pool” is made up of exactly 2 tokens which make up a trading pair. In the below example, I’ve supplied liquidity to the rBTC and SOV pool.

I’ve supplied 5 SOV, and 0.002617 rBTC. When supplying liquidity to a pool, you have to deposit “equal” amounts of tokens. 5 SOV is roughly equal to .0026 rBTC.

Just like in lending, I can see my rewards accrue to me in real time. My rewards are able to be withdrawn at anytime as well.

Bonus Events

If you look in the top row, you see a square that says 30k SOV. These are extra SOV rewards given to liquidity providers. It is an incentive to provide liquidity to the pools. Since I am providing liquidity to the SOV/rBTC pool, I am entitled to a share of the 30k SOV.

Participating in Governance with SOV

One of the most intriguing aspects of Sovryn is the governance mechanisms. You can lock up SOV for an extended period of time, granting you voting power. In return for staking SOV, you are entitled to a cut of all fees charged on the network. You can see I have $0.30 USD waiting for me to claim! Needless to say, I am going to wait for my rewards to be higher before claiming any of them.

Locking your Tokens

On Sovryn, you are incentivized to lock your tokens for long periods of time (years). The longer you lock your tokens, the more voting power and rewards you receive.

As you can see, I’ve opted to lock my tokens for quite some time. I personally like going all-in on experiments. I can unstake my tokens earlier than the unlock date, but I would only receive a percentage of the total amount of SOV I locked up. In other words, there is a disincentive to unstaking early.

Margin Trading with Bitcoin

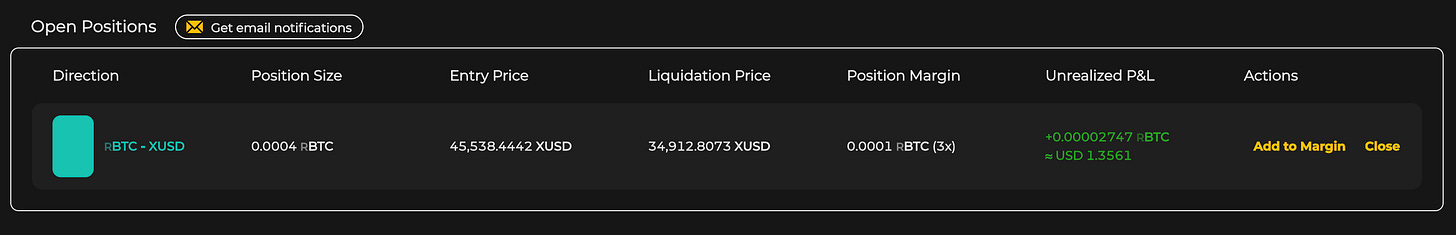

You can margin trade on Sovryn pretty easily. Margin is trading with borrowed money. I’ve written about that in earlier letters.

I’ve opened a very small margin position on Sovryn, really just to try it all out.

I’m not expecting to get rich off this margin trade. The intention was to get familiar with how the whole process of margin trading on a DEX works. I’ll likely play around with margins on Sovryn a bit more as I move more capital onto the platform.

Bridging Tokens to Sovryn

One very crucial aspect of Sovryn is the ability to port popular tokens from other blockchains onto Sovryn. We already covered that BTC can be bridged to Sovryn and turned into rBTC. But you can also turn ETH into ETHs and BNB into BNBs.

I wanted to provide liquidity to the BNBs/rBTC pool on Sovryn, but in order to do so I had to convert BNB into BNBs using this bridge.

Observe that I am starting with 0.1 BNB under STARTING CHAIN. Then on the DESTINATION CHAIN, I am receiving 0.09 BNBs. There is a 0.01 BNBs fee to be paid for the conversion process. After I got a hold of the BNBs, I added them to a liquidity pool to earn yield.

Sovryn Origins

The Sovryn Launchpad is for projects that are looking to raise money, and distribute their tokens to ecosystem participants. The first project to be featured within the Sovryn Launchpad is BabelFish (FISH). They raised $5.8 million worth of bitcoin during the sale. A chunk of FISH was airdropped onto users who are staking their SOV. I personally received about 140 FISH tokens currently worth $30. FISH is unlikely to be the last project featured and airdropped onto stakers of SOV.

FISH Token

FISH is the governance token of BabelFish, the project responsible for building and maintaining XUSD, the primary stablecoin of Sovryn. Just like SOV is the governance token of Sovryn, FISH is the governance token of the BabelFish project. BabelFish is in the early stages of building a decentralized autonomous organization (DAO). Discussions on the progress of the first set of proposals for BabelFish can be found on their forum. FISH will be able to be used to vote on proposals that guide the direction of the BabelFish project. BabelFish aims to be useful not just to Rootstock but to multiple blockchains.

FISH went through an initial token sale and airdrop. Stakers of SOV were airdropped FISH tokens which can later be used to participate in the governance of BabelFish. While still in its early stages, BabelFish looks promising to me. They’re aiming to provide a concrete benefit to Sovryn; Aggregate stablecoin liquidity into a single stablecoin for Sovryn; and Rootstock in general.

What is the XUSD Stablecoin?

XUSD is very interesting as it is a stablecoin that results from aggregating liquidity from multiple pools, across multiple platforms. Think of it like this, rather than having BUSD, USDC, USDT, DAI, and a host of other stablecoins on Sovryn, there is XUSD which is an aggregate of all of them. When you want to bridge BUSD onto Sovryn, you receive XUSD. This is a much simpler, and in the end more efficient system than maintaining a ton of different stablecoin trading pairs, and liquidity pools.

Exclusive Offer for Sovryn Users

I usually reserve these sorts of guides for my premium subscribers. But I felt like this guide should be something that is free for everyone to read. So I have an offer for my readers.

I will give anyone a year-long membership to my premium newsletter at 20% off if you pay me through the Sovryn ecosystem. That’s $80 in whatever Sovryn based token you want to give me. (SOV, FISH, rBTC, or XUSD). Contact me on telegram at @BitcoinKeegan.

Becoming a premium subscriber means you can vote on future topics, and get access to more of these kinds of exclusive guides. Lastly, you get to see inside my portfolio, and commentary into why I’ve selected the projects in my portfolio.

Happy being Sovereign,

Keegan