This week, I set up a bitcoin mining farm in Wisconsin for Sazmining.com. It runs on 100% hydroelectricity, and all the rigs are owned by customers. One of these rigs are my own. While there, I had lots of time to think about Bitcoin Mining. What is it? What does it do? How does it work? Why does it work the way it does? These are some questions that I’ve answered before, but today I’m doing to explore a new thought. One that is connected to business and entrepreneurialism as much as it is bitcoin. It’s the idea that bitcoin is the perfect customer that always buys.

The Perfect Customer

Running a business is hard. One of the toughest aspects is building your customer base. Every entrepreneur knows that the perfect customer is one that repeatedly buys your product. If you find a loyal, repeat customer, treat them like gold. The perfect customer will repeatedly purchase your product, ask no questions, require no support, never ask for a refund, buy often, settle immediately, always come back for more, and most importantly, never runs out of money.

Bitcoin Buys Energy

The Bitcoin network is far more alive than one any of us might like to admit. It is an active purchaser of approximately 94.70 TerraWatt Hours (TWh) per year [ source ]. At roughly $0.05 per KWh year, Bitcoin “buys” $4.7 Billion dollar worth of energy per year. Once again, it doesn’t ask questions, it doesn’t care where the energy comes from (maybe a bad thing?), it always wants more, and it always has money to pay.

It’s not intuitive to think about bitcoin mining in this way. Bitcoin doesn’t make decisions like a regular customer. It doesn’t have consumer choice, and the quality of never running out of money to purchase more is a property typically reserved for billionaires and central banks.

The other way to think about bitcoin mining, is that miners sell energy to The Bitcoin Network, and it pays BTC (₿) for it. It’s actually a remarkable agreement that miners have with Bitcoin, as it transparently declares that it will pay less (in BTC terms) every four years. In fact, The Bitcoin Network cuts the rate that its willing to buy energy by 50% every 4 years due to an event called “halvings”.

BTC Price Cycles

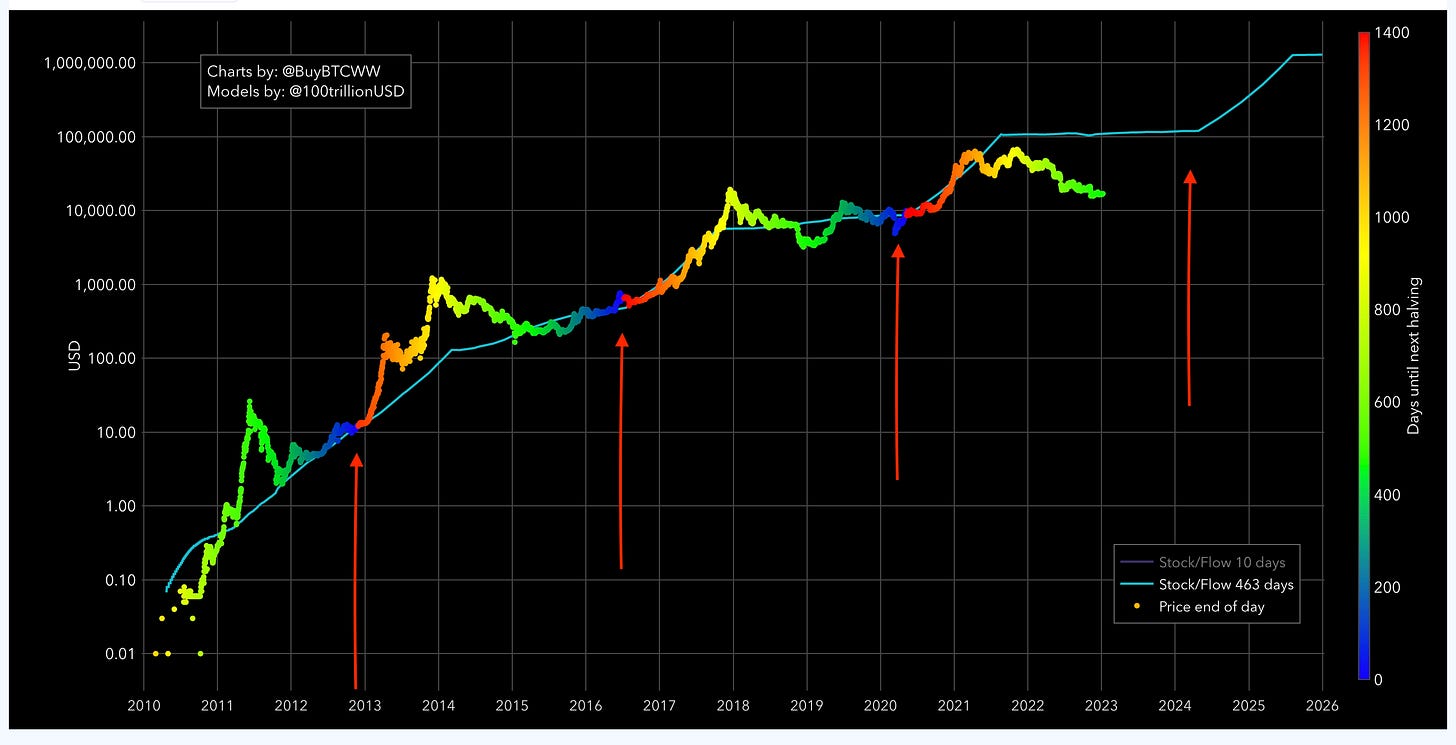

The price cycles that BTC goes through is hypothesized to be integrally connected to the halving events.

Let’s take a step back and analyze what happened from 2009 onwards. In 2009, The Bitcoin Network was willing to pay 50 BTC for minuscule amounts of energy. But then again, BTC had absolutely no value at the time. Eventually, BTC became a novelty among enthusiasts and nerds.

As soon as BTC gained some “non-zero” valuation. That is, as soon as someone else was willing to buy BTC (or sell goods and services for it), BTC began its inevitable ascent to where it is today.

The price of BTC increased to the point where the incentive to mine BTC was very high, and the barrier of entry was very low. Bitcoin could be mined on a laptop CPU. This incentive structure prompted entrepreneurs to capitalize. Investments in computers were made, more people began to mine bitcoin.

The way to interpret this is the following: People were, and are, continually willing to sell more energy for less bitcoin over time. This is the pure and simple supply and demand mechanic that drives the steady increase in price of bitcoin.

The Perfect Service Provider

Yes, Bitcoin is the perfect customer. It’ll always buy energy, it’ll always need it. It is a cybernetic organism that lives on electricity. Without it, it’ll die. But The Bitcoin Network is also the perfect service provider. It has near 100% uptime in the 14 years that its existed, beating out the top Goliath internet companies such as Amazon, Google, and Apple in uptime. It doesn’t discriminate on who its users are, so in this way, it is happy to serve any and all customers.

If the Bitcoin user base stayed the same (approx 200 million people globally), I am pretty confident that the price of bitcoin would continue to rise, purely for the mathematically derived rationale I laid out above. But overlay the structure of bitcoin on top of the growing demand for BTC, and bitcoin’s absolute dedication to not care who uses it, and we have a potent situation for explosive growth.

If bitcoin ends up having a similar adoption curve as the internet itself, then we will see a chart like the one below. [ credit inbitcoinwetrust.substack.com ]

Hard to Compete with Bitcoin’s Service

The reason why Bitcoin is the perfect service provider is the same reason it’s hard to compete with America. The USD is the world reserve currency, and the central bank gives the country essentially an unlimited supply. They are able to print what seems like unlimited units of it. Well… The Bitcoin Network can’t print unlimited units of it, but it does have a monopoly on being the only thing that can print new units. The network itself will always be the core manufacturer and distributer of new BTC units and block transaction fees.

Bitcoin is offering a trifecta of services that no other single financial institution offers. Bitcoin is Visa (payment provider), JP Morgan Chase (Bank), and the Federal Reserve (Money Printer) all rolled into one. It runs at a fraction of the cost and energy of any of these aforementioned businesses with none of the corruption; provably. It has outsourced its infrastructure and is on orders of magnitude more robust and decentralized than any other business could ever hope to achieve.

Legacy financial institutions will have to adopt, or die.