One of my newer readers recently told me a story. He had asked his mom whether or not she thinks if inflation can rise forever. In the moment, I said “of course it can”, but after putting in more thought on the matter, I think the answer is no. How could it? Inflation rising forever would mean that prices rise forever. While in theory (ex. Modern Monetary Theory), central banks may be able to keep printing money forever, in practice, we know from a brief analysis of history that every currency reaches a breaking point.

So if inflation can’t rise forever, the question then becomes, when does a currency break?

TL;DR;

This is a bit of a longer post of mine. If you want the cliff notes, here they are, if you want the rationale, buckle up, its a 7 minute read.

By historical example, inflation can’t rise forever. All currencies have a breaking point. That breaking point is when the currency is inflated too quickly or when a better alternative takes it place through selection by the free market.

Wildcards to changing economic dynamics are CBDC’s and Bitcoin

What is the Breaking Point of an Infinitely Inflating Currency?

There are several ways we can go about answering this question. But first, I want to lay out a major assumption that I am making while delivering this thesis. This assumption comes with two exceptions or wildcards.

The Assumption

There is nothing economically unique about the time we live in. That is, although technologically our financial systems have evolved and become digital, this does not change the underlying mechanics of human action (praxeology) as it relates to supplies of money within a society.

The Wildcards

I see there being two wildcards that could invalidate my assumption. Both of them are rooted in digital reality. They are as follows.

Bitcoin represents a “0 to 1 innovation” in money. It’s 14 years of existence is insufficient in determining whether or not it fundamentally changes the underlying economic mechanics governing money.

We have never had a globally mandated and enforced central bank digital currency (CBDC). We can speculate on the novel features of a CBDC (real-time decay of money, money that expires, socially preferential tax schemas, at-source and/or on-demand taxation, selective spending). However, we have not seen the deployment of a CBDC at a scale necessary to determine how such a digital currency or its features, would shift the paradigm of monetary supply management, or human action as it relates to the economy.

With these assumptions and wildcards in place, I am now free to lay out what I feel is compelling evidence that we’re on trajectory to reach an economic breaking point within a very short period of time.

The Historical Breaking Point

Finding historical analogs for the decline in purchasing power we see in our modern currencies is actually not hard at all. We don’t have to look far to find examples of currency debasement, counterfeit, or outright theft perpetrated by the highest levels of government and the banking establishment.

The Fall of Rome

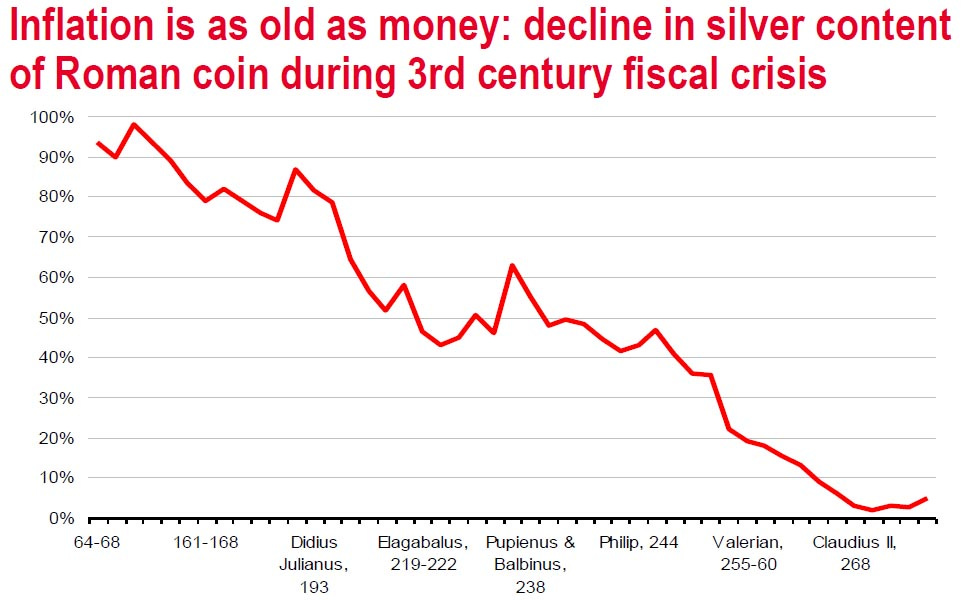

Coinciding with the fall of Rome, and in my opinion a massive contributor to it was the systematic debasement of their currency, the Denarius.

This is a chart of the silver content within the Denarius. What was taking place at this time in history, was Rome was becoming bureaucratically top-heavy. That is, the cost of running the government and its armies (Military Industrial Complex) was expanding far beyond the means to pay for their existence.

The strategy employed by the government was to reduce the silver content of the coins, and mint new coins with ever decreasing ratios of silver. In effect, they created more units of currency with the same amount of silver. This doesn’t increase the value of each coin, but simply puts more of the coin in circulation. This gave them increased spending power, without putting in the work to earn more units of value. Debasement is an economic lie, time theft. Eventually, Father Time always comes to collect on his debts.

The Fall of the Pound Sterling

The British Pound is the oldest currency still in existence and use. Despite massive depreciation in the purchasing power of each unit of currency, the currency is still functional today.

The massive devaluation you see in the 1500’s is known as “The Great Debasement”. During this time King Henry VII ordered gold and silver coins to be replaced by cheaper metals such as copper. King Henry was at was with France and Scotland and needed additional funding (that wasn't available). Debasement is a way for nations to prolong otherwise fruitless wars.

Once the debasement happens, despite what politicians might tell you, is never reversed. Prices may come down, but it won’t be because the currency increased in value, it will be because technological advancement has made it cheaper to produce and distribute (see Jeff Booth’s Price of Tomorrow).

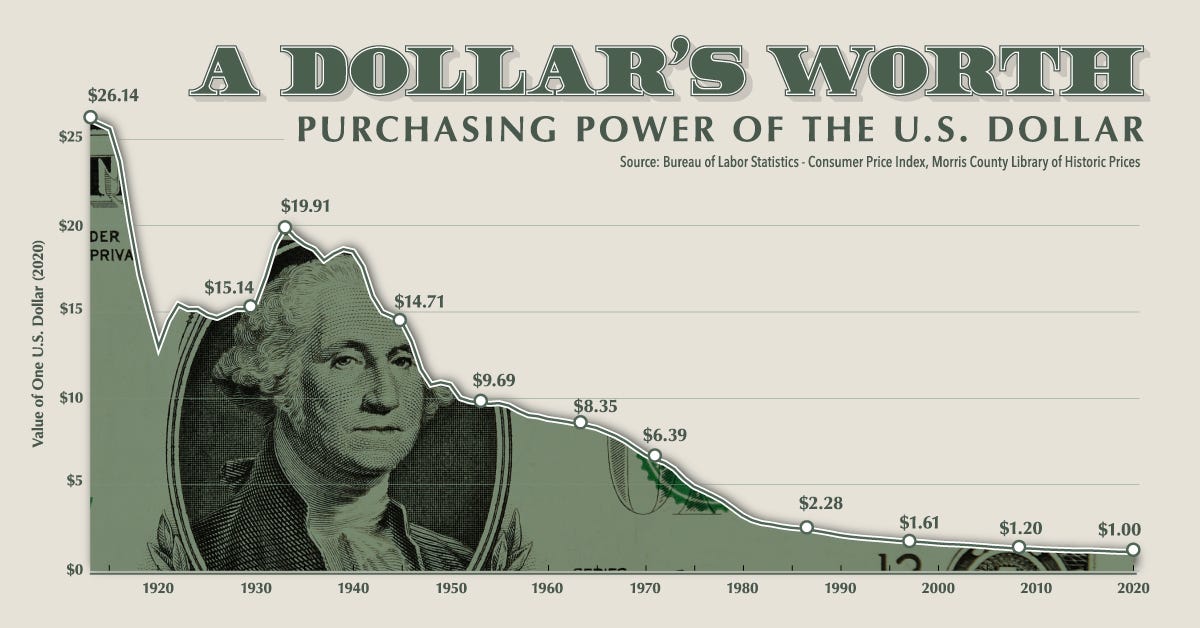

The Fall of the American Dollar

I could show you dozens of examples of failed currencies including Venezuelan Bolivar, Argentine Peso, Weimar Germany’s “Papiermark”, Turkish Lira, the list goes on. In all instances, the destruction of the value of the currency is accompanied by an astronomical rise in the supply of the currency or a debasement of the existing supply. So why then, after an astronomical rise in the supply of USD has the USD not failed yet?

Usage (“Acceptability”) Can Delay Obsolescence

One of the six properties of money is Acceptability. That is, something is money only if it is accepted by society (the populous). As is the case with the longest standing currency (British Pound), although it has lost more than 99% of its purchasing power since its inception, it is still in use. Apparently, even if a money is still a Medium of Exchange (MoE), it can hang onto its status as a money.

Will the USD Fail?

So with this knowledge in hand, the USD will fail if enough people stop using it (in favour of a different money) in tandem with a rise in supply that is too much too fast. The latter may trigger the former. In periods of currency decline and debasement, people are triggered to seek a better Store of Value (SoV), despite Medium of Exchange (MoE).

The above chart is of the M2 Money Supply in the United States. We’re on the up-tick part of the exponential curve that is USD monetary expansion. If the money supply expanded as the number of people using it also expanded, we might not see as drastic inflation as we have in the past few years. But as I stated before, if a currency expands its supply too much too quickly, people will begin to look elsewhere.

Other Macro-Economic Actors Look Elsewhere

Russia, China, Saudi Arabia, and India are each economic powerhouses. Apart, they might not be able to displace the USD as the preferred global Medium of Exchange and Unit of Account. But in recent days they’ve inked several agreements to begin buying and selling energy resources (Coal, LNG, Oil) in Yuan. For context, the entire world has been forced to buy oil from Saudi Arabia using USD. This massively strengthens the USD in the context of a currency. From this point onwards, the USD is going to have less users to the tune of several billion people.

The Perfect Storm

Less Users + Increase Money Supply = Accelerated Currency Decline

It looks like a perfect economic storm is brewing. I’m not sure where America (or Canada for that matter) will land in it all, but to be honest, it doesn’t look good. However, I still believe that the collapse of the most used currency in history (USD) will happen in slow motion. Unlike Balaji who believes hyperinflation will happen in the next 75 days, I think the grip that the USD has on the world economically and psychologically will erode gradually and slowly, rather than suddenly and all at once.

Inflation Cannot Rise Forever

To answer my original question in clear terms. Inflation cannot rise all at once. But, we can pivot to more of the same. For example, the USD could be replaced with a better, yet still decaying fiat currency (such as the Yuan). It could also be replaced with a much more easily manipulated digital currency such as a digital USD.

Until a critical mass of people decide to opt-into bitcoin, and demand its use at the political and governmental level, I do believe that we will be bound to the use of ever-decaying fiat currencies. So whole inflation cannot go on forever, it can go on for decades, or in the case of the British Pound Stirling, centuries, if the people don’t stand up and demand a better economic paradigm.

Luckily, bitcoin is a peaceful opt-in currency. Unlike government and central bank issued currencies, it demands no one use it. It must be voluntarily understood and adopted. Whether it will be or not, is another letter.

Thank you,

Keegan