Green Bitcoin Mining

An in-depth look at Sazmining

This week I bought a mining rig. I will never see the mining rig itself, yet on a regular basis, I’ll see some bitcoin trickle into my wallet. I bought the rig from a company called Sazmining. They are a customer-centric bitcoin mining company that runs 100% of their rigs off of green and renewable sources. In the case of my rig, the energy will come from a hydroelectric dam in Wisconsin, United States.

In this letter, I’m going to dive a bit deeper into Sazmining, and bitcoin mining in general. It’s been a while since my last newsletter debunking the environmental FUD on bitcoin. This letter will serve as a bit of an update to the environmental discussion as well as a look into a green bitcoin mining operation.

Mining as Easy as Setting up a Netflix Subscription

For many, bitcoin mining is thought of as weird way for nerds to make money. Back in 2009, bitcoin mining could be done on any regular laptop computer. Since then, it’s gotten a lot more competitive and in order to be profitable, you need a specialized computer called an ASIC (Application Specific Integrated Circuit). Then you need to think about where you are going to run it. If you run it at your home or in your garage, you probably won’t be profitable, as you pay consumer rates for the electricity. After you plug it in, you can access an interface in a browser that allows you to configure a bitcoin address that the miner will send BTC to.

The bottom line is, between buying the miner, getting it shipped, finding somewhere profitable to run it, plugging it in, configuring it, and maintaining it, Bitcoin mining is inaccessible for the average individual.

This is where Sazmining comes in.

They make bitcoin mining as easy as setting up a Netflix subscription.

They take care of the purchase, shipping, setup, and hosting. All I have to do is pay for the rig and pay a monthly electricity bill (subscription based). Then bitcoin from the miner is automatically deposited into an address of my choice.

What does Sazmining get out of this? They take 5% of the bitcoin mined. Fair deal.

Purchase Steps

I’ll lay out how easy it was to buy the rig.

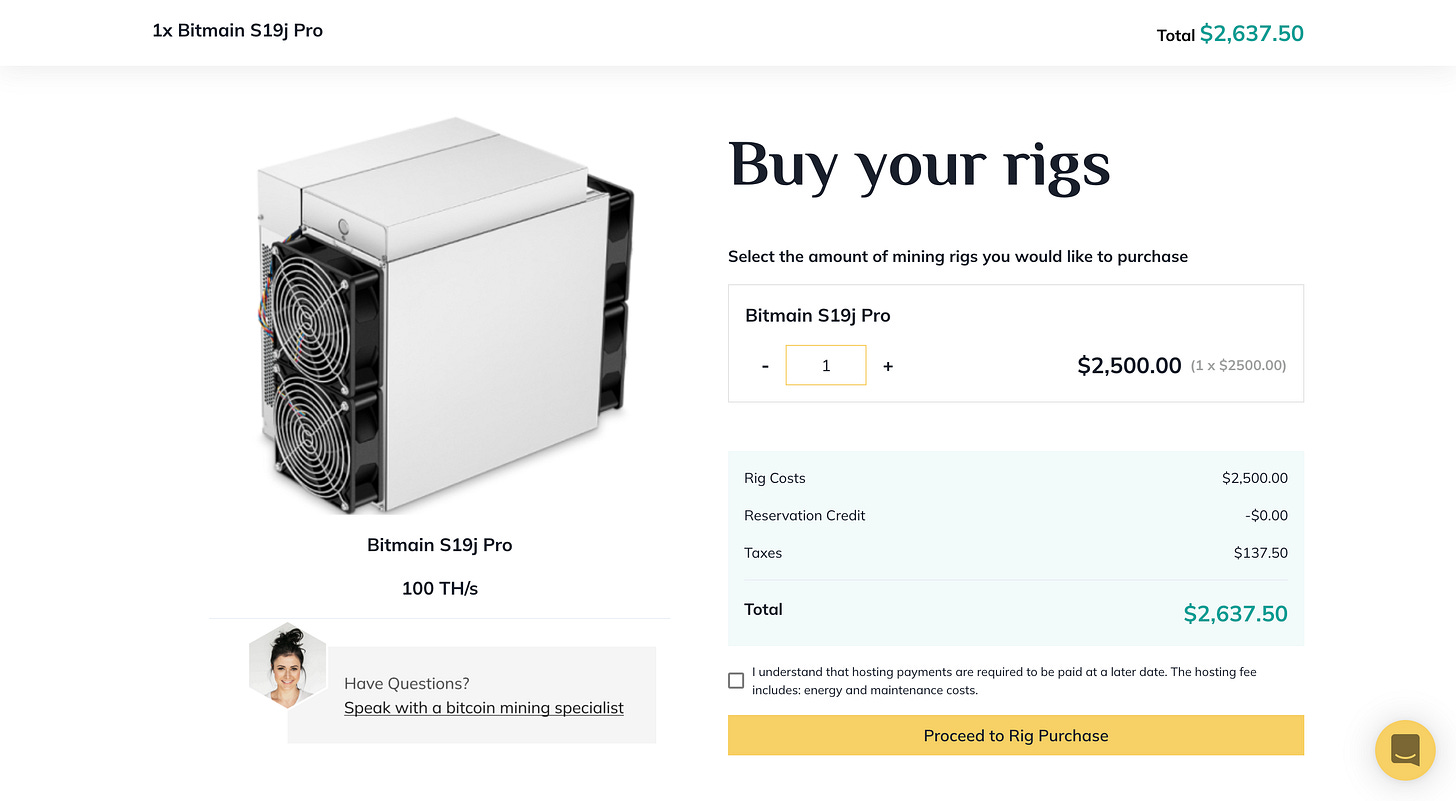

Step 1: Choose how many miners you wish to buy.

Step 2: Choose the payment method

Sazmining currently supports 3 payment options.

BTC and USDC (I chose to pay in BTC because it was quick and easy)

Bank Transfer (US Only)

Wire Transfer (US and International)

Step 3: Pay for your rig

The next page depends on which payment option you chose. Since I chose Bitcoin, I was taken to a bitcoin payment processor. After sending my Bitcoin along, I was notified by Sazmining that they’ve received my payment. This is the moment I became a proud owner of a bitcoin mining rig.

A Customer Centric Approach

One of the reasons why I am aligned with Sazmining is because they’ve chosen to build their business with the customer at the very centre of it. What do I mean?

They sell the rigs to their customers at cost. If they pay $2,500 per rig, so do I.

They charge a monthly amount that covers electricity, maintenance, and hosting. Same amount every month. No surprises.

They transparently take 5% of the yield from the mining rig.

Profitability and Tradeoffs

Since I’m a die-hard bitcoiner, I think in terms of BTC with respect to profitability. The miner cost me 0.15 ₿ , and over the course of the lifetime of the rig, I expect to get something like 0.287 ₿ back. Now, A LOT of things can change in the next four years (average life of a miner) that would change my expected return.

Total Network Hashrate going up reduces my return in BTC terms

Price of Bitcoin going up increases my return in USD terms

The Halvening around May 2024 reduces my BTC returns by 50%

Why not just Buy Bitcoin?

Honestly, this is a perfectly fine option. I was considering buying 2 miners, but instead, I will opt to buy just 1, and us the money for the other money to dollar cost average into bitcoin slowly. The two main reasons why I bought a miner was as a diversification strategy and as a dollar cost average strategy.

The miner is a one-time-purchase of $2500 USD

I owe $180.00 per month for the life of the miner.

I expect to get about 0.006 ₿ (~$100 currently) per month for 4 years.

Essentially what is being offered to me is the ability to buy 0.006 ₿ for $180. This is not the greatest deal when BTC = $16k USD. But if you consider where bitcoin is eventually heading, let’s say, to $100k per bitcoin, then .006 ₿ is $600. I’m buying the ability to buy $600 worth of bitcoin for $180. I have no problem admitting that there is risk here. If bitcoin doesn’t go up, then I’ve made quite the unprofitable investment. Call me irrational, but I’m pretty optimistic about the long-term with bitcoin.

Debunking the Environmental Argument

I’m not going to reinvent the wheel here. Since mid 2021 when bitcoin came under fresh (but not novel) criticism for its energy use, a handful of extremely talented a thorough researchers got together to arm the bitcoin community with facts, figures, and most importantly, logic in order to combat the argument that Bitcoin is bad for the environment. So rather than lay out all of the arguments, I’ll just link a few of the articles and podcasts and put the onus on you to DYOR.

Bitcoin Mining and Ocean Tech - 5 Star, knock your socks off podcast. Must listen.

Hydro Bitcoin Mining in Rural Africa - Gridless

Onwards and upwards folks. I’m happy to answer any questions you may have about this bitcoin mining opportunity. Have a safe and happy December.

Keegan

I have 6 months at Saz in Paraguay. Extrapolation looks to me like I will make $800 yearly cash flow from a $2300 investment; about 3 years to break even. Mostly because BTC has gone up so quick during this time. Without this appreciation, I would never break even. I'm glad I have a rig, but its not been a good investment. Your thoughts?