In my previous newsletter, I went over 4 application that help you stack sats. I also included some screenshots with some less-than-impressive earnings. For example, the podcasting app Fountain had me earning 1 satoshi per minute of podcasts I listened to. At that rate, it would take me 3,559 minutes or 2.47 days to earn a dollar worth of bitcoin. At the same time, I said that I psychologically like to think about those satoshis as if each one of them were equal to a dollar. The question that naturally comes after (besides “Are you nuts?”) is, “when will 1 satoshi (ϟ) = $1?

TL;DR;

We need to see 3559x increase in bitcoin (or depreciation in the $)

By the time 1ϟ = $1, we will probably be using bitcoin, not dollars for trade

Bitcoin is fire insurance and we’re in a burning building

I’ll be an old man when 1ϟ = $1

Hyperinflation and Hyperdeflation

There are two things that alone could make 1 ϟ = $1. The fact that both things are happening at the same time make me think that 1 ϟ = $1 will happen sooner than we think. A skeptic will say that it’ll never happen, but I’ll leave that debate for another letter.

Since a satoshi is worth 3,559x less than $1, there are two ways of thinking about how to reach dollar/satoshi parity. Either bitcoin appreciates in value by another 3,559x, or the dollar depreciates by 3,559x. My money is (literally) on both of these things happening at once.

The dollar IS going to continue inflating and thus depreciating in value

Bitcoin IS going to continue deflating (in supply) and thus increasing in value

Analyzing when exactly this dollar/satoshi ($/ϟ ) parity happens is quite tricky, but there are a few things we can say about the world we will live in when this happens.

A Hyperinflated Dollar

Even though a satoshi will equal a dollar at some point in the future, that satoshi will not carry the same amount of purchasing power as a dollar in 2023. To illustrate what I mean, let’s take the example of a dozen (12) eggs. Currently, a dozen eggs costs about $5 USD (~$7 CAD). After years of accelerated inflation degrades the value of a dollar, a dozen eggs may rise in price to be $50 USD. A 10x degradation in the value of a USD. At this point and time, assuming we have $/ϟ parity, you would need 50 satoshis to buy that carton of eggs. In other words, a satoshi would carry the same purchasing power as a penny would today.

So just because we’ve reached $/ϟ parity, doesn’t mean that your satoshis carry as much purchasing power. Another way to illustrate this is with the comparison between being a millionaire today and a millionaire in this distant future. By owning 1,000,000 ϟ (0.01 ₿), you could be a millionaire. However, in the example laid out above, being a satoshi-millionaire in a world where a dozen eggs cost $50 USD is as impressive as having $100k USD today.

I know these relativistic value calculations are confusing, but here is the rub.

A Post-Dollar World

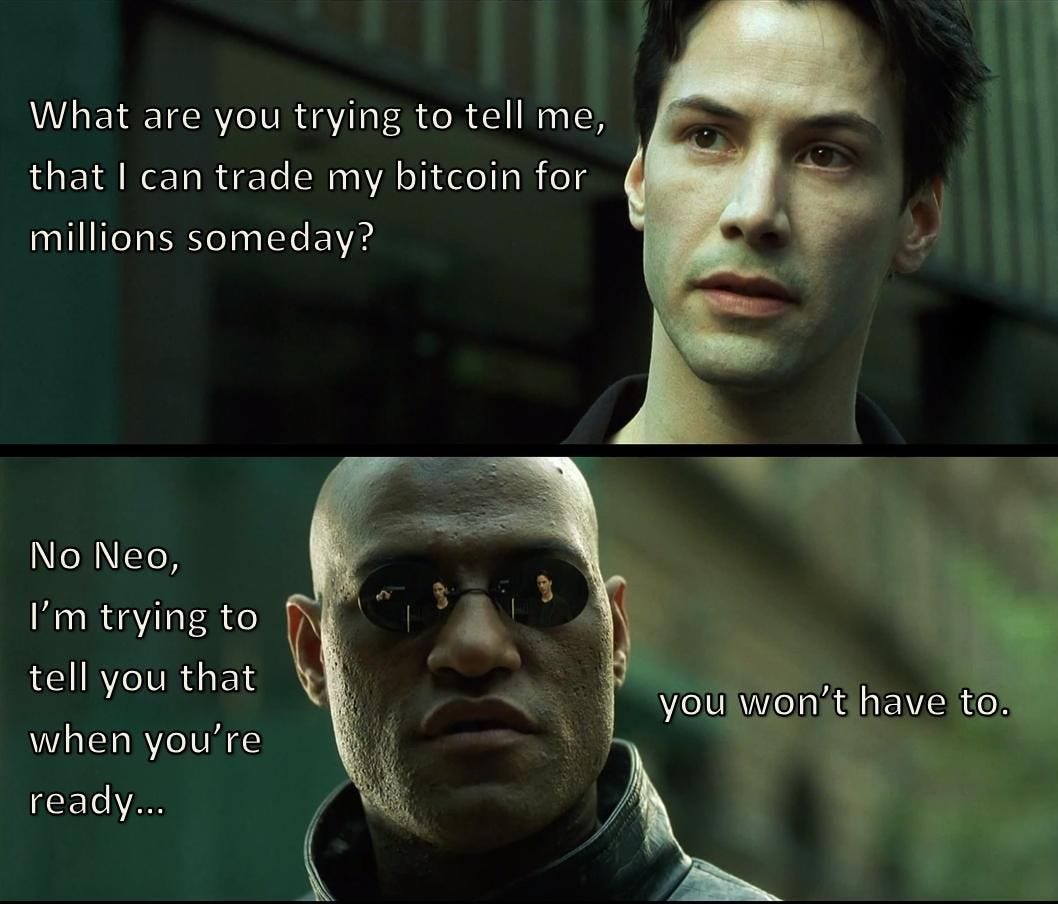

People often think of bitcoin as an investment. This is short-term (high time preference) thinking. You might be buying bitcoin today because you’re thinking that at some point in the future, you can sell it for USD, CAD, or EUR and make “a bunch of money”.

Part of the message I am trying to communicate to people is that bitcoin is not an investment, its an insurance policy. You’re an early adopter to the next form of money the globe will use after the collapse of our respective nations fiat currency. Bitcoin is insurance against the inevitable collapse of our monetary system. When we’re all ready, we won’t have to convert bitcoin into dollars, you’ll just spend it as regularly and as easily as you spend “money”.

Bitcoin is fire insurance for a burning house

I want to double-down on this analogy.

Imagine you’re in a burning house and an insurance salesperson is trying to sell you fire insurance. Pretty obvious decision in front of you right? Buy the insurance, cash in.

Now imagine that person denying that the house is on fire.

That is sometimes how I feel when explaining bitcoin to people. The economy is the burning building, the 1928, 1971, 1988, 2001, 2008, 2020, and present day financial crises are the smoke, Satoshi Nakamoto is the insurance salesperson, and bitcoin is the insurance.

It’s not If, it’s When

Let’s assume that bitcoin doesn’t actually accrue any more value as a network or asset. (Even though it has historically doubled in value year over year for 14 years straight). Counting only on the depreciation of the USD alone, when will $1 = 1ϟ?

Well, there are 21 quadrillion satoshis in existence (21 million bitcoin * 100,000,000 ϟ per ₿).

So $1 will equal 1 ϟ when the value of the dollar has depreciated to the point where the total value of all goods on the planet equals 21 quadrillion. According to this website/graphic, all things of value on the planet today equal between $500 and $700 trillion.

I struggle to equate “valuing things in the market” with “bitcoin’s market cap reaching the total value of things in the market”. So on the lower end of money in this world, there is about $95.7 trillion dollars worth of currency, and this is the number we’re going to work with.

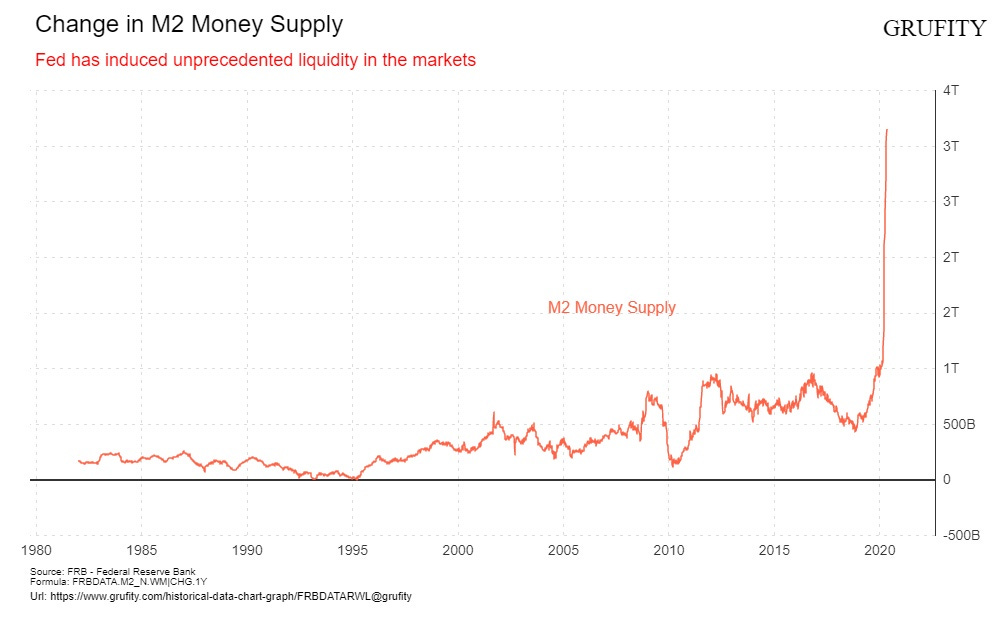

The question is, when does the money supply reach 21 quadrillion if it is currently sitting at 100T? The answer is, in about 51 years assuming 10% inflation year over year. 109 years assuming 5% inflation. However, I think thats being generous to the teams behind the money printing.

The money supply doesn’t look like slowing expansion anytime soon. As far as I’m concerned, we’re one war, crisis, pandemic, or event away from needing to print trillions more.

In response to this, I’m stacking sats, regardless of the price of those sats in USD. It’s trivial and a cliche, but …

1 ₿ = 1 ₿ and 1 ϟ = 1 ϟ

When Will 1 ϟ = $1?

It’s fun to speculate as to when this might happen, but for me, the answer doesn’t actually change much about today, or my behaviour. I’m still going to aggressively accumulate bitcoin in anticipation of perpetually higher prices. I’m still going to use my 4 apps to stack bitcoin (among other things). Chances are, I’ll be an old man by the time 1ϟ = $1, but so be it. It’s not really about the destination, it’s about the journey.

Cheers,

Keegan

Buy Me a Coffee Update

I updated my “Buy me a Coffee Page” to include multiple tiers of memberships. If you don’t want to contribute through my substack payment portal, I’ve given you the ability to contribute to me for as little as $1 per month. Which, I would totally be grateful for! Every little bit helps!