When Mrugakshee and I set out to Go Full Crypto in June of 2020, we knew that we had to have our bases covered. As it turns out, financial services are essential to living a comfortable life. Debt is an extremely useful instrument, and so is earning a good interest rate on your idle assets (cash or otherwise). When we were searching the world of cryptocurrency for financial services that met our needs, there was one company that stood out to us. Crypto.com is a company that offers us the ability to take loans, earn interest, and spend directly from a specialized VISA Debit card. This only scratches the surface of what they offer us, so in this letter, I’m going to break it all down.

Spending with Crypto.com

If we were going to have any hope of giving up our traditional bank account, we were going to need a way to spend our cryptocurrency. Or at least easily convert our crypto into Canadian dollars to spend. This is exactly how the Crypto.com VISA Debit card functions. You’re not actually spending cryptocurrency when you swipe your card at a terminal or ATM. You’re spending whatever FIAT currency you’ve configured in your app. However, within the app, you are able to convert BTC or USDT to CAD seamlessly. I can be standing in line the grocery store, and convert USDT to CAD on the spot, then pay with my card 30 seconds later.

Are the Card Perks Worth It?

Mrugakshee and I acquired the Rose Gold Card. This is the second highest tier of cards that Crypto.com offers. This gives us the following perks:

5% Cashback in CRO on everything

100% Rebate on Netflix, Spotify, and Amazon Prime Subscription

2 Passes into Private Airport Lounge

10% off of Expedia Purchases

Access to Crypto.com Private Research Papers

Extra 2% on Crypto Earn [more on this later]

The Rose Gold tier of cards now costs $40,000 USD. Admittedly this is a little much for any card, no matter what the perks are. However, that $40k is locked up and invested in CRO, not spent. We earn 10% on that amount, and can withdraw it after 6 months, although we forfeit the perks.

Is it worth the expense? It really depends on whether or not you take advantage of the perks. The main perk that got me interested in this tier was the extra 2% on Crypto Earn. This perk actually has the potential to make the $40k price tag worth it.

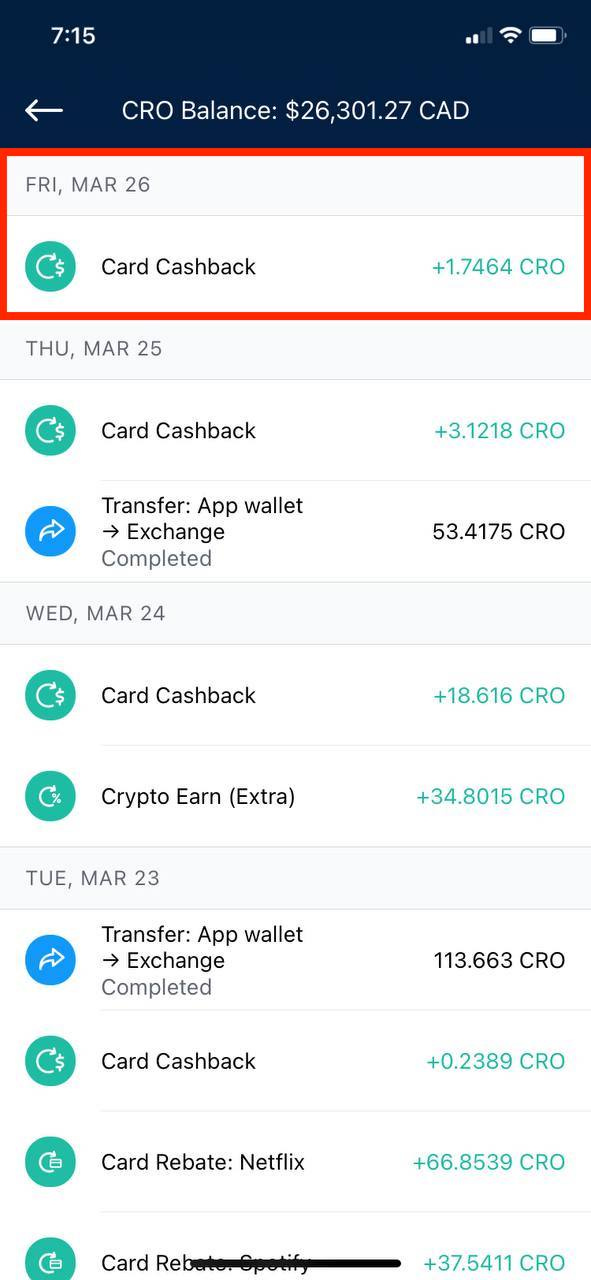

The Cashback is Instant

The below screenshot is an example of the cashback I received. While writing this letter, I had a coffee at a cafe. I paid using my Crypto.com VISA Debit card, and instantly received 5% cashback paid in CRO. I am free to take that CRO and do what I please with it. Most times, I deposit it in the monthly supercharger event [more on this later].

Earning with Crypto.com

This is one of my more favourite aspects of the entire Crypto.com ecosystem. Crypto Earn is the savings account you always wish you had with your bank. You are able to loan out your money that you’re not using and earn interest on it. Crypto.com allows you to lend dozens of cryptocurrencies including Bitcoin, USDT, and Ethereum. I really only lend BTC and USDT.

If you’ve read my earlier article on my portfolio allocation, you’ll know I am 95% in Bitcoin.

There are minimum deposit requirements in order to earn interest on your cryptocurrency.

Weekly Payouts in the Asset You’re Lending

If you lend USDT to the platform, you get paid out in USDT. If you lend BTC to the platform, you get paid out in BTC. The payouts are deposited directly into your Crypto.com app on a weekly basis. This is great because you can then take your weekly earning and spend it on your Crypto.com card. The implications of getting paid out in the asset you lend is that as the price of your cryptocurrency rises, the interest you received last week, month, or year also increase in value. That simply rocks.

Flexible Lending to Suit Your Needs

Crypto Earn gives you three options to choose from with respect to lending assets. The three options are Flexible, 1 Month, and 3 Month terms. The longer the term, the higher the interest rate. I use a combination of 3 Month and Flexible terms in order to maintain flexibility within my portfolio.

What are the Rates on Crypto Earn?

I encourage you to check out the earn calculator on Crypto.com to discover which assets, rates, and durations best suit you. If you’ve managed to acquire the Jade Green/Royal Indigo or Rose Gold/Icy White tiers of the Crypto.com Card, then you are awarded with higher earn rates. For Green/Indigo you get an extra 2% on all your terms. For White/Gold, you get yet another 2%, but it’s paid out in CRO instead of the asset you’re lending. This was the main motivation for me to upgrade to the Icy White/Rose Gold tier. I end up earning 14% APY on 3 Month stablecoin deposits, and 8.5% APY on my Bitcoin.

The Higher the Price of BTC, the More CRO Bonus

One of the things that is not immediately obvious about the extra 2% paid in CRO, is that the amount of CRO you receive is based on the USD value of the BTC. So if Bitcoin is rising in price and CRO is falling, staying the same, or rising slower, then I am earning more units of CRO as part of my 2% bonus. I’ve included some screenshots so you can observe what I am talking about directly.

Keep a Flexible Balance of USDT When I’m not Spending

I like to think of the Flexible tier of Crypto Earn as my chequing account, and the 1 Month and 3 Month terms as my savings account. I am able to earn 8% on my USDT stablecoin when it’s in a Flexible earn term. When I need $100 for groceries, I simply take it out of my Flexible earn term and fund my VISA Debit card with it. The effect is that I am always earning a good rate on my money. It’s all about making your money work for you.

Borrowing with Crypto.com

Debt is an important financial instrument to have access to. Crypto.com has made it so I can access credit at the click of a button. The experience of obtaining a loan with Crypto.com is far smoother than anything I have ever experienced in a traditional financial institution. With respect to getting a loan at banks, there are credit checks, paperwork, and ultimately a lot of time before I can get the credit I need. Lately, due to my chosen line of work, banks have decided not to give me credit at all.

Crypto.com has several lending products available to me. The more CRO you stake, the better rates you get from Crypto.com. You can either get credit from Crypto Credit (within the App) or the Lending Interface within the Crypto.com Exchange.

Crypto Credit

IMAGES AND CONTENT REDACTED — [ May 1st 2022 ]

Crypto.com Exchange Lending Interface

IMAGES AND CONTENT REDACTED — [ May 1st 2022 ]

Providing BTC as Collateral

I don’t mind putting my BTC up as collateral because I am not concerned about Bitcoin falling to the point where I am “Margin Called”1 or “Liquidated”2. Each one of these loans work according to a ratio known as the “Loan to Value”3 ratio. That is, how much collateral is covering the underlying debt? If the value of the collateral drops too much, then Crypto.com will automatically sell the Bitcoin on my behalf to make sure I don’t default on my debt. My underlying assumption is that Bitcoin is not going to drop by 25-35% in a single day. I will typically have an opportunity to pay down my debt so that I don’t get liquidated and lose my underlying collateral.

Bitcoin falling too far too quickly is the risk of using Bitcoin as collateral.

Trading with Crypto.com

I do have a philosophy of never selling Bitcoin, however, the following trading strategy is my exception to that rule:

Assumption: Bitcoin will continue to rise to above $100k USD by August 2021 as per the Bitcoin Stock to Flow Ratio.

Use Bitcoin as Collateral to take out a USDT loan

Buy Bitcoin with the USDT

Wait for the price of Bitcoin to rise

Sell the Bitcoin I bought to cover the loan balance

Keep the difference as profit

Rinse and Repeat

This trading strategy will only work as long as my underlying assumption stays true. I will likely stop implementing this strategy around June/July as by this time, I will be less certain of Bitcoin’s continued rise. The higher Bitcoin goes, the more risk of being liquidated as I see there being a higher likelihood of a 25-35% drop in the price of Bitcoin.

Keeping Track of Trades

If you don’t keep track of your trades, I recommend you start doing so. This is especially useful if you’re implementing the above strategy as it is of the utmost importance that you pay attention to the LTV ratio of your loans.

I use a simple spreadsheet application to keep track of my trades. I record the following information:

The Purchase Price of BTC

How Much BTC was Purchased

The Sell Price of BTC

How Much BTC was Sold

IMAGES AND CONTENT REDACTED — [ May 1st 2022 ]

As you can see, I can make a good little chunk of money by capitalizing on relatively small movements in the price of BTC. I always take profit in BTC by selling less than I bought. I am left over with an amount of USDT which I either use for paying my expenses, or increasing my holdings in some of the other cryptocurrencies I am interested in (ADA/CRO).

Supercharger and Syndicate

The Crypto.com Exchange offers you several means of increasing rewards. This is just another way that Crypto.com creates incentives and rewards for users that engage with their ecosystem. The two programs are the Supercharger, and the Syndicate.

Syndicate Events

The Syndicate is an event wherein you are able to purchase cryptocurrencies at a 50% discount. If this sounds too good to be true, keep reading, as there are a couple of caveats to this event.

Crypto.com holds these events once or twice per month, so its not like you can purchase cryptocurrencies at 50% off whenever you like. Next, there is a cap on the amount of assets they sell at 50% off. They typically cap it at $500k worth of whatever cryptocurrency is featured. Although, they have done $250k, $1M, and $2M events in the past.

In order to participate in the events, you need to stake CRO on the exchange. The more CRO you have staked on the exchange, the more you are eligible to buy in the event. Lastly, you must trade a minimum volume of USD on the exchange within a 30 day period.

IMAGES AND CONTENT REDACTED — [ May 1st 2022 ]

See the Crypto.com Syndicate Event Page for the latest details.

Supercharger

IMAGES AND CONTENT REDACTED — [ May 1st 2022 ]

Charging Period

Every day of the month, Crypto.com takes a snapshot of how much CRO is deposited into the Supercharger. If you have 100 CRO deposited and there is a total of 1,000 CRO contributed by everyone, then your current score is .1 or 10%. This is a trivial example because there is far more than 1,000 CRO in the Supercharger at any given point of time. At the end of the first 30 day period, your score determines how much of the Supercharger rewards you will receive. For the next 30 days, you will receive your rewards once per day.

Rewards Period

I chose this screenshot to illustrate how the rewards work. In the month of January, I was “charging” for the ZIL Supercharger. Then, every day in February, I received some ZIL. Simultaneously in February, I was charging for the next Supercharger, which was for NEAR. Then every day in March, I receive a bit of NEAR.

IMAGES AND CONTENT REDACTED — [ May 1st 2022 ]

This is a really amazing program that encourages engagement on the Crypto.com Exchange, and gives you some passive income at the same time. The original idea behind the Supercharger came out during the summer of 2020 when Yield Farming and Liquidity Mining was booming. In order to profit from yield farming, you needed a good bit of capital, and sufficient technical understanding of what you were doing. Crypto.com lowered the bar for participating in these passive income strategies, whilst almost completely removing the required technical understanding.

For more information on the supercharger event, visit the Crypto.com Supercharger Event Page.

Crypto.com Launches their Own Blockchain

The last note I want to touch on in this letter is the launch of the Crypto.Org blockchain. This is the blockchain that now drives the entire Crypto.com and Crypto.Org ecosystem. It launched on March 25, 2021. It features high transaction throughput, low fees, an NFT marketplace, and 20% APY for staking your CRO. If you’re reading this before March 31st 2021, simply by signing up on Crypto.com/nft, you can get a special NFT that celebrates the launch of Crypto.Org Chain.

Crypto.com has consistently impressed me with their ecosystem. Every single month they deliver new features and new ways for me to earn money within their ecosystem. I am happy to declare them my Crypto Bank and I hope to use them for all of my financial needs for the foreseeable future. I will be writing more on Crypto.com and their new blockchain as more information comes to light. I hope you enjoyed this letter as it details a big chunk of how Mrugakshee and I manage to live Full Crypto.

All The Best,

Keegan Francis

The contents of this letter are for informational purposes only. None of the information shall be taken as investment advice. I will not be held responsible for losses incurred from implementing any of the strategies detailed in this letter.

Margin Call Definition - https://www.investopedia.com/terms/m/margincall.asp