Options, Futures, Derivates, Margin Trading, and Perpetual Swaps — What do these terms all have in common? Each of them are trading instruments that let you bet on the rise and fall of the underlying asset. What they all have in common, is that each of these activities involves taking on debt in some way shape or form.

I’ve been curious about debt for a long time. The concept of borrowing, and owing more later always seemed to be bad on the surface. This was until I understood that you can use debt to increase the size of your returns. Furthermore, having access to debt at a good interest rate is a very valuable thing in and of itself. Credit is an essential financial service, and one that many of us go without. Getting debt within the world of cryptocurrency is actually a pretty simple thing to do. You can often get a loan, as long as you provide collateral, with just a couple of clicks. This letter is about how I obtain debt using Crypto.com, in order to turn a profit.

Apply specific knowledge, with leverage, and eventually you will get what you deserve. — Naval Ravikant

Nothing in this newsletter is financial advice. I am not encouraging you to trade derivatives or take on debt using cryptocurrency or any other means. This letter is for informational purposes only. I will not be held accountable for losses incurred from implementing any or all of the information present within this letter. Do your own research, and do not take on any more risk than you can handle.

Understanding Leverage

Before you can use leverage to your advantage, you must first understand it. Leverage can be understood in a financial sense, and that’s predominantly how I will be talking about it with respect to debt. However, it is also worth noting that leverage, in general, is the ability to multiply rewards by utilizing tools, or your competitive advantage. For example, your Specific Knowledge1 is leverage over anyone else in your domain without that knowledge.

Leverage is Debt

In the financial sense of the word, leverage is debt. Debt is neither good nor bad. It depends on how you use it, and on the parameters of the debt agreement. When you take on debt in the trading world, you do so with the aim to get a return that exceeds the interest you will pay on that debt. Observe this trivial example in order to further understand the point.

I take out a loan of $10,000 and pay 5% APY. At the end of the year, I owe $10,500. If I am able to make a 20% profit on the loan, then I make $2,000, and owe $500, resulting in a $1,500 profit. The scenario gets interesting when we scale the numbers. Instead of taking out a $10,000 loan, imagine we take out a $1,000,000 loan. Assuming we still pay 5% APY and can make a 20% profit, we end up with a $150,000 profit. In terms of absolute value, that is a much better return than $1,500.

How to Obtain Debt

There are two main ways to obtain debt. The first is through your credit score, the second is through providing collateral. In either case, you need to prove to your creditor that you are able to cover the interest payments, and the principle amount. In cases where you are taking on a lot of debt, both are typically required. In the world of cryptocurrency, credit scores don’t really exist. Consequently, the dominant way of taking on debt is by locking up collateral. I frequently take out a loan to buy more Bitcoin on Crypto.com by providing the Bitcoin I already own as collateral.

The Structure of Collateralized Debt

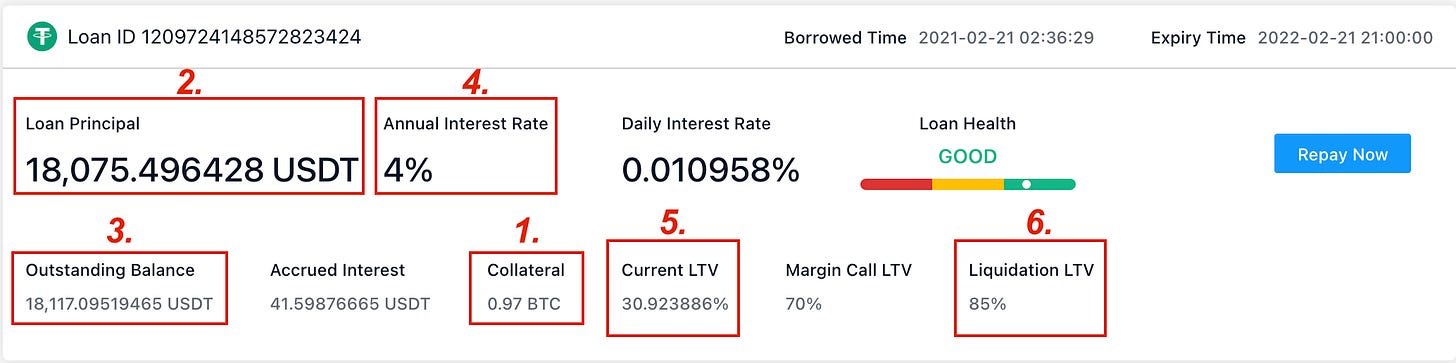

All debt obtained through collateral is structured the same way. I’ll be using one of my loans as an example in order to explain the terms.

Collateral - I provided 0.97 BTC as collateral. When I took out the loan, Bitcoin was worth $54,226.47. I took out 33% of the value of the collateral as debt (i.e. $18,075.49, labelled under 2. and referred to as Principle)

Loan Principle - The amount of money I took out as debt. I owe this amount of money, plus interest.

Outstanding Balance - The current total amount of money that I owe, i.e. Principle plus Interest.

Annual Interest Rate - The amount of interest I am charged for having borrowed the Principle.

Current LTV - LTV stands for “Loan to Value” ratio. This is the ratio between the value of the outstanding loan divided by the value of the collateral. This is perhaps the most important thing to understand about any loan that you take out with cryptocurrency.

Liquidation LTV - The LTV for this particular loan started at 33%. If the loan to value ratio rises too much, then you can get margin called, and then liquidated. All Crypto.com loans get liquidated if the LTV increases to 85%. Using the numbers present in the screenshot, if the value of Bitcoin drops to $21,900 (18075.49 / (.97 * 21900)), then my loan will be “liquidated”. A liquidation of my loan means that the collateral I provided to take out the loan is sold to repay the loan. Liquidation is among the worst things that can happen when taking out a loan because I completely lose that 0.97 BTC.

Scales of Leverage

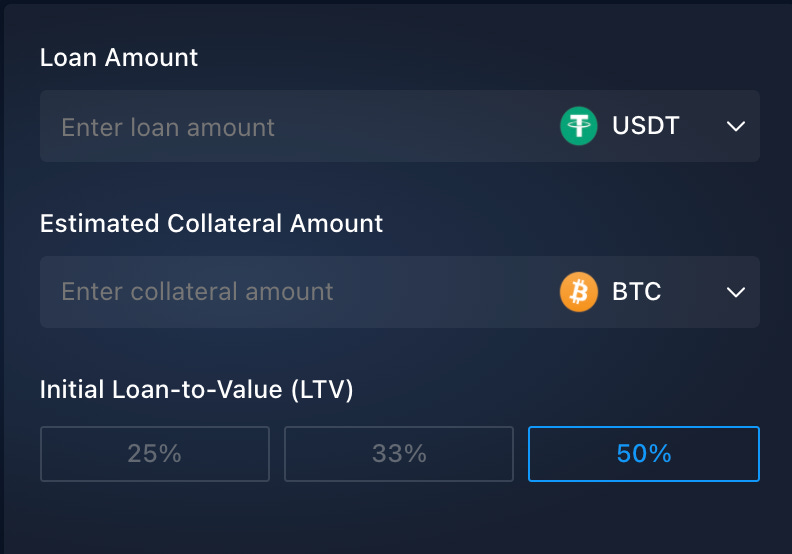

Through the lending interface, you are able to take out a loan with an initial LTV of 25%, 33%, or 50%. It is useful to understand these percentages from a different perspective. If we’re trading with the borrowed funds, it can be said that we’re using…

(25% LTV) : .25x leverage

(33% LTV) : .33x Leverage

(50% LTV) : .50x Leverage

In general, each of these loans are low risk, especially when using Bitcoin as collateral. Bitcoin is much more stable than it ever has been, and is unlikely to drop by 35%, 52%, or 60% in a single day. THAT BEING SAID, IT IS STILL POSSIBLE AND YOU SHOULD PAY ATTENTION TO THE MARKET WHEN USING ANY AMOUNT OF LEVERAGE.

More leverage is available to you, but you have to use Derivatives. I will be covering this in Part 2 of the letter.

The Takeaways

Debt is not good or bad, it is how you use it that counts

Debt in the crypto world can be obtained by providing Bitcoin (and other cryptocurrencies) as collateral

Making sure your LTV stays at a safe level is key to not getting liquidated

Taking on debt is inherently risky, and should be done so with knowledge and care

Regards,

Keegan

Naval Ravikant — Specific Knowledge