Fungibility - The property of a good or a commodity whose individual units are essentially interchangeable, and each of its parts is indistinguishable from another part — Wikipedia

NFTs are the latest phenomenon to explode out of the cryptocurrency industry. There is always something creating a lot of hype in the world of cryptocurrency, and for the last couple of months, it’s been NFTs. The intention of this letter is to answer the questions you might have about NFTs. What are they? Why are they worth so much? Is this hype justified?

TL;DR

NFTs are unique tokens that are typically “one of a kind”

The quality of uniqueness make them ideal for representing originality in Digital Art

The tokens are confined to the platform they are created upon (ex. Ethereum)

The hype around NFTs is something that warrants caution

What Are NFTs?

Non-Fungible Tokens are tokens that cannot be divided into pieces, nor copied. Fungibility is a property of money referring to whether or not its pieces are like the others. For example, in Canada we have the loony. One loonie is $1 CAD. If I have a loonie, and you have a loonie, there is nothing about my loonie that makes it more valuable than yours. We could trade loonies, and each have the same amount of value.

It can then be said that loonies are fungible.

NFTs are tokens that are unique. One of a kind. NFTs are Non Fungible Tokens.

Examples of NFTs

Digital Art (.png, .jpeg, .gif)

Digital Music (Albums, Songs)

Digital Real Estate (Land, Units, Buildings)

In each case, NFTs are used to determine the following

Originality (When and By Whom it was created)

Custody of Ownership (Who bought it, when, and for how much?)

What are NFTs Used For?

With NFT’s, each one is unique, and thus cannot be equated with any other NFT. This kind of token allows us to model things in physical reality that are unique. An example of unique things in physical reality is a deed to a house or a plot of land, an original piece of music, or an original art piece. Think of the Mona Lisa, there is only one of them. There are many fakes, but only one original. How then do we tell which one is the original, and which are the fakes?

In the art world, there is something called the chain of custody1. This is a record of who owned the art piece, when, and for how long. This chain of custody is the predominant way of determining originality in art pieces (although modern carbon dating methods also help with determine authenticity2). Regardless, the chain of custody must be validated and then trusted by acquirers of fine art. The validation process can be time consuming and costly.

In the world of NFT’s, originality and the chain of custody is built into the supporting software. Blockchains record who created the NFT, when they created it, and each account that has owned it since it was created. In short, blockchain establishes, and maintains the chain of custody automatically. Validating the chain of custody can be trusted and done instantly when dealing with NFTs on the blockchain.

P.S. - Just because something is “on the blockchain” doesn’t mean that it can be trusted.

Why are NFTs so Valuable?

At the end of the day, like beauty, value is in the eye of the beholder. Therefore I can’t give you one concrete reason for why any one NFT is valuable. I can however lay out both sides of the argument so you can decide for yourself.

The Case for NFTs

NFTs give artists new ways to monetize their art. Ways that either did not exist, or were inaccessible to them. Artists may now turn their digital piece of art into an NFT and sell it on NFT marketplaces like opensea and rarible. Before NFTs, artists would have to contact distributors and art dealers that would take care of the sale. This oftentimes would result in the artist receiving a fraction of what the piece actually sells for.

Not only do artists receive the lions share with the NFTs they create, some NFTs will give the creator a cut every time the NFT changes hands, creating passive revenue streams for the artist. This makes sense for the artist, but what about the purchasers of the NFT?

I believe that purchasers of NFTs can be divided into three categories. People that buy NFTs typically fit into one or more of these three categories.

Speculators: People who are buying NFTs to speculate on the price movements

Enthusiasts: People who are buying NFTs because they are a fan of the what the NFT represents

Collectors: People who collect things that are rare, if only for personal pleasure3

NBA TopShot, Leading NFT Platform

We need not look any further than NBA Topshot to discover examples of people investor for each of the above reasons. People are able to “own” moments of NBA history, or frames of their favourite player making a slam dunk. Think baseball trading cards that sell for thousands of dollars per piece, but digital. People are buying TopShot NFTs because they love basketball, because they think their NFTs will rise in value, or simply because they want to collect something that is limited edition. For one reason or another, humans like things that are rare4. Since the debut of NBA TopShot in late 2020, more than $230 million worth of NFTs have been traded on the platform.

Watch out for the NFL, MLB, and FIFA versions of this platform!

The Case Against NFTs

As far as I can tell, there are two major flaws with NFTs. That is the platform that they exist on, and the nature of digital content.

Ethereum, the Dominant NFT Platform

Most NFTs exist on a single platform, and that is Ethereum. These NFTs cannot be traded to another blockchain such as Cardano, or Binance. They are confined to, and dependent on the platform where they were first minted. If Ethereum were ever to fail, so too would all of the tokens and NFTs that were created on it. Any and all future sales of the art must take place on Ethereum. This requires that Ethereum exists far into the future, which I have a hard time confidently believing. Physical art doesn’t have this problem because all physical art is minted within the same platform; Physical Reality.

Digital Content is Copyable

The fact that digital content is copyable all but destroyed the record label business. Overnight a service called Napster5 made it so anyone can share and distribute music for free. Some would argue that downloaders of the music are stealing it, as they haven’t purchased the right to own, or a license to listen. Regardless of which side of the debate you’re on, the fact still remains that digital content is copyable. Yes, you can create a NFT that immortalizes the time and date of creation of your NFT, but others may still gaze upon the piece of art.

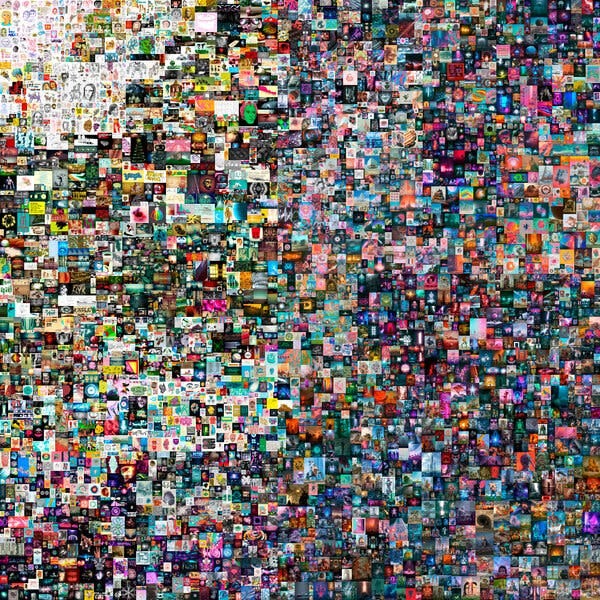

Someone paid $69.3 million dollars for the NFT connected to the above image. I can post the image here on this letter for free without attribution. Showing it gives no royalties to the author, or the current owner. So what then justifies the price of this piece of art? I would return to my original sentiments on value. It is in the eye of the beholder. For me, the fact that I can copy the underlying .jpeg trivializes the entire digital art space.

Is All the Hype around NFTs Justified?

While the value of something is in the eye of the beholder, I do think that NFTs are overblown. The same sort of craze that drove the 2017 ICO bubble, and the 2020 DeFi bulls is now driving NFTs. What people don’t realize is that they are buying the hype, rather than the things underneath of the hype. I will personally wait to see what becomes of the NFT space before buying any. I think NFTs are fascinating, but I don’t think their true use case has been discovered yet. I am more aligned with my critiques of NFTs than my understanding of the value underneath of them. Furthermore, as I explained in earlier letters, I am uncertain about the future of Ethereum. I am therefore hesitant to purchase anything that lives on Ethereum.

You will no doubt hear more about NFTs from me in the future as the space develops. It is an area that I am watching closely and will deliver you with insights as they come to me!

All the best,

Keegan

Chain of Custody - https://en.wikipedia.org/wiki/Chain_of_custody

Radio Carbon Dating - https://www.pnas.org/content/116/27/13210

Hi, thank you for the interesting read. What do you think about the use cases of NFTs by brands maybe to drive engagement and create communities with exclusive memberships, any take on that? Thank you

Loved the read Keegan!